The classic way of trying to understand the buying process really has only one major drawback, and that’s that it doesn’t help you understand the buying process.

How It’s Usually Done

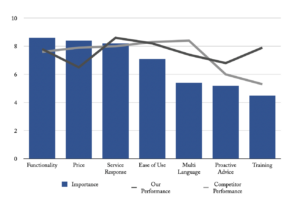

Here’s the classic approach people use to understand how customers make purchasing decisions. First you ask customers to rate what’s important to them (aka their key selection criteria or key purchase criteria). Then you ask them to rate you and your competitors against those criteria. You then chart it up to add a bit of analytical credibility, to get something like this, which you then over analyse and draw your conclusions.

Standard importance-performance assessment of the buying process

This kind of analysis has its place in strategy but it’s based on shaky foundations (people don’t make decisions by weighted analysis of relative performance, even in tenders where they pretend they do) and it misses much more valuable parts of the actual decision making process.

A Better, Fact-Based Approach

A better approach is to establish the facts around the full process of how people actually buy to get the whole picture. Then draw conclusions based on how people actually made their decision in real life.

Here’s what we look at when we investigate the buying process, and why. It’s supposed to follow the full life cycle of the decision. Missing any of these steps leaves a big potential gap in understanding.

We always do this line of questioning hand in hand with further questions about performance and about relationship security, but those are subjects for another day.

How to Do This

The only way to do this is to interview people. It needs the attention and exchange that comes with a conversation. Trying to do this via an online survey gets the same amount of attention as you give when your broadband supplier sends you a text asking how likely you are to recommend them.

If you’ve got thousands of customers, and you feel the need to hear about this from hundreds of them to get some quantitative insight, by all means do an online survey. But only do it after you’ve interviewed a bunch to really understand how they buy. And if the survey responses disagree with the interviews then there’s something wrong with the survey.

Why Do This?

Customer referencing, understanding the buying process and the business’s performance in that process is obviously important to investors in a business. But the process done well yields insights that management almost always uses to make changes in how it sells and markets, and sometimes in what it sells and markets. This is despite the fact that almost every company already has some form of regular satisfaction survey and has sales people working the market every day.

Getting a skilled third party to do this yields better results than doing it yourselves because customers will say different things to a third party than they will to their supplier. That customer who let you down gently by saying you lost on price, told us something completely different and more uncomfortable.

The big picture though is that only by getting the real life story of what actually happened do you get the rich picture of how people make buying decisions and what you can do about it. An abstract list of selection criteria and ratings of performance against them is a paint by numbers cartoon in comparison.