Key performance indicators focus the top team on the handful of things that make most difference to company value. These KPIs have a pessimistic, red teaming but very necessary twin, aka Key Survival Indicators. These are the handful of things to monitor to make sure we’re around to enjoy that increase in value.

Key Survival Indicators are for the top team’s targeted attention, so they’re more focused than the contents of the risk register. There’s just a handful of them. They’re also more wide ranging and tangible than the necessary liquidity and solvency indicators that lenders, shareholders and some customers require.

The Usual Approach

Companies typically use patchwork approach to creating the set of measures they use to assess company survivability. It typically starts with things the company needs to measure for third parties, such as lender agreements. Then they might add some risks that are staring them in the face, a couple of things that came out of due diligence if that happened recently, and finally a couple of things that bit them in the ass in the past. The result is a hodge podge, largely driven by reactive requirements.

A Better Approach

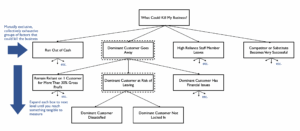

A more useful approach is to take control and ask question like, “What could kill my business before I have time to do something about it?” Once you group and categorise those things, you get a structure like this.

You want this group of risks to be mutually exclusive and collectively exhaustive, i.e. there’s no overlap across them and no gaps between them. You can’t be too literal with this because you just want the big groups and can ignore anything minor, but it’s a useful test to check you’ve covered what could be important. For example, for this company there’s no big or strategic suppliers, so we don’t need a box that covers supplier risk.

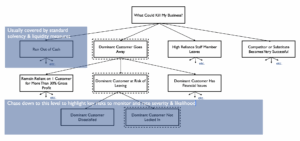

This structure is too generic to be useful. So you take each group and break it down into components, like this. After a couple of levels, you’ve got a list of tangible things that could kill your business.

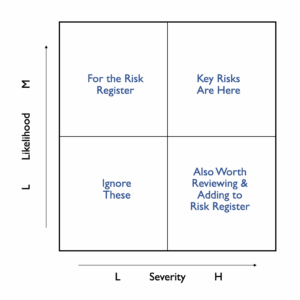

This list from a completed breakdown is way too long for any kind of top team focus. So we borrow a simple prioritisation tool from those masters of profiting from risk – insurance companies. Assess each risk according to its likelihood and severity, and anything that’s medium likelihood and high severity makes it onto your list of key survival criteria.

The consequence is that you get a list of much more tangible and commercially relevant things to monitor, over and above the usual liquidity and solvency measures.

When & How To Use Key Survival Indicators

The times to pay attention to key survival indicators are when the business is at its most vulnerable. This could be after demand or supply shocks, cash crises, after major internal events such as senior staff changes or reorganisations, under new ownership, or if leverage has been increased significantly.

Most of the time, they can be traffic lighted so the top team can focus on the KPIs safe in the knowledge that in the background we’ve got our red pilled KSIs to monitor what’s important to have survival covered.