Market sizing exercises are typically poor without you realising it. They usually come up with over precise estimates that, when challenged, give you no confidence in their robustness. And they don’t do the job you need them to do. With some changes to the standard approach, you can to fix this.

What Market & Why?

Two little questions can save you a whole lot of time. They can turn your market size exercise from deceptively accurate and wrong to robustly challenged and valuable.

The first question is, “Why do I want to know the size of the market?” The answer to this question is almost always, “I need to know it’s big enough for my growth ambitions (and I don’t care how big it is as long as it’s bigger than x).” This answer leads you down a totally different approach to market sizing than the much more uncommon situation of wanting to be confident in its size to the nearest five or ten percent.

The second question is, “What market do I want to size?” Is it an actual market being serviced right now, or do I want to know the potential market for a new product type? Is it just for the core product or is it for all the envisioned add ons, wrap arounds, and tacked on services? Is it the value of the entirety of potential demand for a breakthrough product? Or is it the steady state annual revenue once the hump of first purchases has passed?

Summary Total or Sweet Spot?

Having got clear on what market you want to size, the next stage is almost always to work out your sweet spot segment and size that. The total market is almost never relevant for all but the most dominant players. For most, everything outside the sweet spot segment either unobtainable or so random that it’s just a bonus.

How to Work Out Market Size

The numerous ways of working out market size fit into 3 main buckets: demand-side self-calculated, supply-side self-calculated, and using existing market research. None of them as are reliable as you think they are. You need to know their limitations and treat them accordingly.

Demand Side Self Calculated

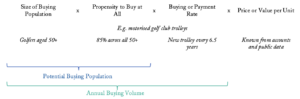

Calculating market size using the demand side in its simplest form looks like this.

It’s almost always more complex than this simple example, which is why you need a spreadsheet and not an envelope:

- Different segments of the buying population can have very different propensities and buying rates

- Products often have up front payments at the start of their life cycles and ongoing payments during them

- Some revolutionary products or products sold into greenfield markets have an initial peak of demand. Then, as the market gets penetrated, you have a lower replacement rate

But even in the simple case, here’s how far off your market size estimate is if you’re +/- 20% out on each of the first three items (you probably know the price accurately in most cases).

That’s hopefully some useful perspective when you’re looking at a market calculated to the nearest £10m. It’s also why a market value of at least £xm or in a range of £x-ym is more useful than an overconfident central point estimate.

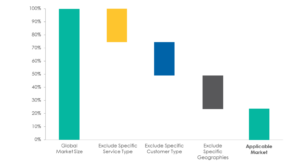

Beware also the subtraction, or “All Fur Coat,” approach to market sizing. This is usually displayed in a flying brick chart like this.

This is visually appealing and has a scientific aura about it. But, unless you’re taking away very small parts of the market and your market remains the biggest chunk, your room for error is enormous.

Let’s assume you’ve taken away chunks worth 80% of the market to leave 20% for your segment. Here’s your error now if you’re +/- 20% out on each chunk.

There’s good reasons for taking chunks of the market away. You may be locked out of certain countries or customer groups. But the better way of handling this is almost always to get the size of the buying population right in our recommended method and resist flying brick charts.

Supply Side Self Calculated

This approach is very tempting and very useful in the right circumstances. It consists of adding up the volumes or revenues of each of the players in the sector.

This approach is great in the following conditions:

- The market is dominated (i.e. 80% combined share or more) by a handful of players

- Each player either makes only that product for 90%+ of its output, or reports it separately in a reliable and honest way

If this is the case, as it is in very few markets, then this approach is the best available one to get the actual market. Though you’ll have to find another way to work out the potential market.

Unfortunately, adding up the revenues or volumes of all the players is a very common approach for market researchers to use, whatever the make up of the players in the sector. Here’s a typical approach, and one used all the time by a leading market research company:

- Find the industry or SIC code of interest

- Look up all the players who report that as their main SIC code

- Add any players who are well known players in the sector but are missing from the list above

- Add up all their revenues, only using separately reported product revenues if they are reported separately

I don’t need to explain why this approach gives essentially useless market size estimates. But if like most people you don’t know how different market research companies go about their work, then that’s the approach to market size you’ll be relying on a lot of the time.

Market Research Reports

If market research reports exist always look at them and potentially use their findings, but only with the following conditions.

- Only pay attention to credible researchers. There has been an explosion in market researchers, particularly in larger and faster growing markets. There are so many newer research companies churning out reports that it’s difficult to be confident about their thoroughness. And the new market research providers almost always vastly over estimate market size and growth. You need to know who is credible and who isn’t before even bothering to look at their estimates

- Understand their market definition. It’s not always clear when researchers are reporting consumer prices versus producer prices, which parts of the value chain are included, whether add on services are included, and misunderstanding this can easily make estimates 50% out

- Call them up to find out how they did their calculations. We always do this whenever we buy a report and they will talk to you. Some are impressively rigorous and thoughtful; others make you worry

- When you have multiple sources, use the credible ones as bounds, and ignore the non credible. We have seen serious consultancies take an average of report findings as their mid point market estimate, giving excellent professional researchers the same weighting as unreliable stack-it-high merchants

- Always, always do your own sense check and self calculation. You should be in the same ball park as the more credible market researchers – if not, something is wrong with either your market understanding or with your understanding of the market research

So What

If having read this you’re wondering what you can trust then I’m happy I’ve made my point.

You need to come right back to the main reason for sizing a market, which is to answer the question, “Is the market big enough?” Take the conservative bound on your sizing. If that’s big enough, and the central case is exciting, then you’re good to go.

by Steve Hacking