Everyone’s Looking at Costs, But We Need to Understand the Importance of Revenue Reliability

Energy prices are jumping by about 80%, and both input costs and wages by at least 10%. So managers and investors are quite rightly focusing on how to deal with those. But there’s likely a much bigger issue coming around the corner in the form of a lengthy downturn. Cost efficiency is the first tool managers reach for to address that challenge, but there’s others in the toolbox; and a critical one is understanding the importance of revenue reliability.

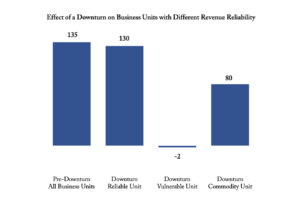

I’ll show what I mean with some numbers. Here’s a company with 3 business units. All have identical P&Ls but very different revenue reliability because they either serve different customer types or provide different services.

An Example With a Simple P&L

This is what each P&L looks like. For simplicity in our business units, SG&A is around 85% people and 15% energy.

Business unit 1 has a reliable revenue stream, i.e. you can push through an inflationary cost increase with a corresponding price increase with no loss of volume. Unit 2 is vulnerable, i.e. revenue to this group falls with GDP, for example it’s in a cyclical sector or has customers in a cyclical sector. Unit 3 is somewhere in between, which I’ll call commodity, meaning you can only push through a price increase at half of inflation without losing business in a price war.

If you think 2 of these situations are a bit downbeat, here’s what happened in the last major downturn. GDP fell by 10% in real terms from peak to trough; and the cyclical sectors fell by more than double that, for example new house building fell by more than 35%. A downturn is also systemic inside product or customer sectors, i.e. it’s hard to make up lost business or price pressure with new business or take comfort from historical repeat business because the entire sector of that product or customer is in decline.

The Effect of a Downturn on Reliable vs Unreliable Business

Assuming your action to address energy costs reduces the 80% increase to 60%, and that you need to keep pace with 10% cost inflation, here’s what happens to each of these units in a 10% GDP reduction environment with a 3% nominal interest rate rise.

So while acting on energy costs and inflation is a great mitigation for the unit with reliable income, it’s a minor matter for the other units. Much more important is the strategic challenge of identifying those businesses that are vulnerable and acting on them.

Reliability in Good Times ≠ Reliability in a Downturn

Unfortunately, knowing the vulnerability of each business unit is difficult because a couple of decades of cheap and easy money with limited cost pressure means that historical patterns and behaviour don’t count for much in a totally different commercial environment. Reliably recurring revenues from good times aren’t as reliable or recurring when the customer needs to save 20% because its revenues have tanked.

In forthcoming articles in this series we’ll look at ways to understand revenue reliability and vulnerability, the additional effect of higher cost of capital, and other tools in the toolbox to address a more challenging commercial environment than the one we’ve had in recent years.