What AreYou Trying to Find Out?

Competitive analysis is a big subject, and one where it’s very easy to get lost, over analyse, and lose track of the handful of insights that are relevant for your particular needs. So the first thing you need to do is be clear about what you want to get out of it, which is usually one or two of 4 different things:

- Understand the strength and sustainability of your competitive position – this primarily informs the revenue line, through an understanding of whether you’re likely to gain, hold or lose share

- Understand the competitive intensity of your supply side – this is about margin: competitive intensity drives down margin more than any other factor in most markets, and is driven by the number of players with a similar enough proposition to yours

- Understand market dynamics (size, growth, profitability of the competitive set) – this helps you understand what drives profit and growth in your sector, particularly the effect of scale and of product/service mix

- Benchmark individual aspects of performance – which is typically about an outcome you’re interested in (customer retention, service ratings, brand value, etc.) and what you can learn about different approaches that appear to achieve those outcomes

You might say I want to know all four, which is fine, but with that comes dilution of attention and more time and cost. There’s always one or two you want to focus your attention on to know really well, and two or three where a good enough understanding will do for now.

I’ll cover the first two in this article. The others are subjects for another day.

What Really is the Market You Want to Understand?

Before analysing anything, you need to draw a ring around the competitive set that’s relevant to the market or niche that you’re in. There’s no point analysing US real estate developers if you’re only in Kentucky and Tennessee. You’ll think you’re up against hundreds when at a local level you’re up against a handful. There’s no point measuring yourself against all the local hotels, from Mrs Miggins’ Sea View BnB to The Grand, when you’re a 3 star mid-budget player.

In a minority of cases, you also just need to remind yourself who are you really competing for. For most companies the answer is customers, but for some it’s not. A talent agency’s real competition is for the stars on its roster; a distributor’s most crucial competition can be for the exclusive rights to a leading brand.

Key Analyses

Once you’re clear on who you’re competing against, 4 big questions help you understand your competitive position:

- What’s important to win and to retain business?

- How well do you perform versus the alternatives (including your competitors, any substitutes, and any DIY or in house alternatives) on each of these factors?

- How sustainable are your distinctions, advantages and disadvantages?

- In some cases, what underlying factors drive each of your distinctions, advantages and disadvantages and how sustainable or defensible are these?

To then understand competitive intensity you need to understand two more things:

- Roughly, how many competitors are out there with similar capabilities to you?

- What are the barriers to entry and scale that might change this or stop this changing?

What’s Important To Win & Retain Business

This is about more than your proposition. It includes anything that makes a real difference to you winning and retaining business: customer awareness, geographical presence, channel relationships, key people, reputation, sales team capability, etc.

The key is to boil the list down to the handful of criteria that really make a difference. Add an extra couple of criteria that make little difference and you end up with the wrong perspective about how well or badly positioned you are.

How Well Do You Perform & How Sustainable Is That

Now you need to honestly rate you and your most important competitors or customer alternatives against these criteria, looking at where you’re ahead, where you’re behind, and what all that means for your overall competitive position.

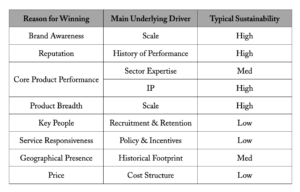

Next you need to look at the sustainability of each of the places where you’re ahead or behind. Here’s some fairly typical important criteria for winning business, underlying factors, and sustainability.

Where the advantage or disadvantage is sustainable, you typically draw strategic conclusions, e.g. which market should we focus on or exit, what should the heart of the proposition be? When it’s less sustainable, you typically think operationally for what to do, e.g. how do we close the responsiveness gap. If you have no strategic advantages, the operational challenge of staying competitive is a serious one.

How Many Similar Competitors Are There?

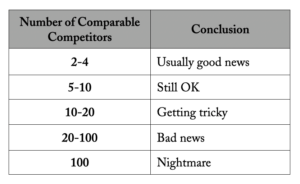

We’ve see markets with only two suppliers that compete away to marginal cost and negative operating profit. But in general more similar players equals greater competitive intensity and lower margins. The key here is to make sure you’re counting similar players that you genuinely compete against, including in house and decisions to do nothing.

Assessing barriers to entry is useful in nascent markets to understand what the competitive intensity is going to be like. But in established markets, assessing barriers to entry is largely a redundant exercise because low barriers will be reflected in lots of small and medium sized players, and vice versa. This is better evidence than a judgement heavy assessment of entry barriers.

Assessing barriers to scale is less common but can be much more helpful, particularly if you’re a current or aspirational leader in your sector. These are often higher than entry barriers and more relevant drivers of competitive intensity at the top end.

Where Do You Get The Information?

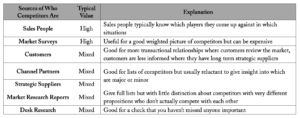

Unless you’re a very small business, senior management is typically a poor source of this information but the one that most people use. Here’s our view of some good places to information on who your most important direct competitors are. We’ve confined it to B2B businesses, because for B2C the sources are often fairly obvious.

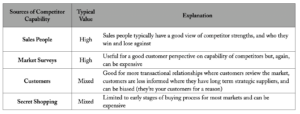

Here’s our view on where to get good information on competitor capability, again confined to B2B.

The answer you get on competitive position after all of this work and insight is leagues more valuable than the typical 2×2 Gartner style quadrants you see in publicity and information memorandums. And it informs crucial strategic and operational changes. It’s also difficult, like lots of valuable things.