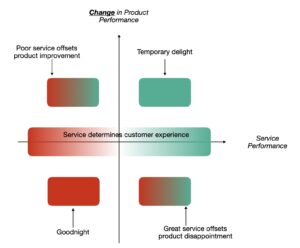

Customer satisfaction with a product is often barely about the product at all. Understanding what matters to customers about satisfaction and performance gives insights that lead to completely different actions than just making the product better.

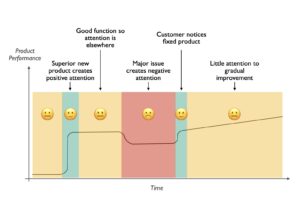

Customers Stop Noticing A Good Product with Little Improvements

A product that does everything the customer needs perfectly well, and improves by small amounts year on year, gets barely any attention. No one is unhappy, no one is delighted. You absolutely have to do it for obvious competitive reasons. But ask customers about a leading, high function, easy to use product and they’ve got very little to say. It works so I don’t have to worry about it and I can spend my attention somewhere else.

There is a time that product functionality, features and quality get major attention. That’s when performance changes:

- When it’s a first of kind product for the customer, they often love it for the first year or so, before their expectations get aligned upwards and they stop paying attention

- When it messes up or becomes difficult, people’s attention is right back onto it, and not in a good way

- When it messes up and someone goes out of their way to fix it, you get more attention again, and this time in a very good way

- When there’s a material step improvement, it gets positive attention for a while until those expectations get reset

The common theme is when product performance changes materially in a good or bad way, so does attention. No big change and that attention goes away.

You can’t get away with a bad product. But a good continually improving product is usually a small piece of the jigsaw when customers talk about performance. In our conversations with customers, the product itself rarely takes up more than 20% of people’s time assessing their supplier’s performance.

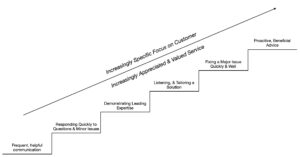

Customers Always Notice the Service Wrapped Around the Product

Customers pay less attention to the excellence of core product than you think they should. Buthe flip side is that they pay lots of attention to everything that wraps around that product and engages the customer as a person. And much of this is people valuing people.

Here’s a list of very common things people praise or criticise proactively when asked about performance:

- Responsiveness to questions and issues

- Quality and frequency of communication

- People going out of their way to handle a difficult situation or fix something

- Listening well to a customer’s requirements and tailoring a solution to match

- Engaging after a sale to make sure the product is well implemented or rolled out

- Excellent personal expertise and advice

A much rarer one totally hits performance ratings out of the park. This is proactive advice to the customer about things that can make their use of the product and therefore their business better. This proactivity is often desired but only rarely delivered.

The complete picture is that big changes in product performance make a big difference to customers’ views of a supplier, but this gradually fades into the background. For the vast bulk of the time, when product improvements are slow or minor, services wrapped around the product are the big thing that customers care about. And these make or break assessments of performance.

How to Get to This

Getting insights about this, what really matters to customers about performance, and where you fall short means talking to people. Tick box surveys about performance don’t cut it. One or two question NPS surveys don’t even get as far as the tick box.

You can’t confine these conversations to your top customers. They’re your top customers for a reason. Just talking to them creates a positive selection bias that needs balancing out by talking with customers whose business with you is declining, unhappy customers, churned customers and maybe even non customers. This is difficult, but it can be done. Done well, it yields a much more realistic and helpful picture than just chatting with the fan base.

And they need to be proper, in depth conversations, opening with simple questions about how you’re performing, then probing about performance in a range of aspects, and taking the conversation a couple of levels deeper when they hint at something interesting or concerning. It means always asking about the gaps. How do we get from a four to a five in communication? What does your best supplier of any service do in any area that’s better than us? What was the best we’ve ever done for you and how does what we’re doing now measure up against that? You’ve rated us perfectly on everything – tell me about something we’re not doing well or that we could do better? What’s coming down the tracks that we need to raise our game for?

Good Performance ≠ Loyalty

Please also don’t make the common mistake of confusing happy customers with loyal customers. They’re kind of related but we see plenty of very happy, even delighted, customers who intend to leave. Getting to the bottom of analysing churn and reasons for churn is another subject for another day. But there is something you should always do when asking about performance, and that’s asking about people’s intentions to stay with you over the next however many years, and asking how much their spend with you will grow or shrink and why.

This connects performance with the commercial reality of churn and revenue growth. It’s something people will always answer, it gives you some of the tangible things you need to do to change performance to make those commercial measures better, and you can bet that many of those changes are going to be about the service without a need to totally redesign or upgrade the core product.