You might be feeling guilty about eating meat because of its heavy carbon footprint. Or you might be in the opposite camp and don’t like how cereals are damaging the planet. Or you may not care about any of that that and think that you can raise profit of your business by just focusing on profitable services. In all of these cases your thinking is all wrong because you’ve made a categorisation error.

Meat ≠ More Carbon

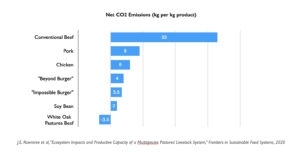

Just leaving aside the contentious way methane is treated when looking at meat’s carbon footprint, here is meat’s footprint versus some alternatives. Make sure to look at the bottom product.

Wait what? Beef can be good?

The way White Oaks rears beef actually takes carbon out of the atmosphere. White Oaks uses regenerative farming and not the traditional industrial farming used in the US for regular beef. Regenerative farming rebuilds the soil microbiome and topsoil depth, and physically captures carbon in the process.

This isn’t the beef fan club. Vegetables farmed using regenerative techniques can also capture carbon, improving the soil as they go. This contrasts with the widespread carbon producing industrial methods that use fossil fuels for fertilizer, and strip away the topsoil with every harvest.

So if we change our categorization to something more relevant, the answer changes. It’s no longer meat bad, vegetables good; it’s industrialised agriculture bad, regenerative good. And we can make much better decisions.

Grain ≠ More Carbon

Grains have just as bad a planet destroying reputation in some circles as meat has in the mainstream. But again grains are just a victim of lazy categorization. Using modern farming methods, grains destroy the topsoil from year after year of ploughing, harvesting, rainwater damage to bare soil, more ploughing, etc. And more carbon is emitted each year in the process.

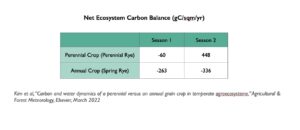

So if we pay attention to the underlying effect of ploughing and categorise grains according to whether we plough or not, i.e. annual grains vs perennial grains, we see a stark and interesting story. Take a look at the results of a recent study on this. In this case a more positive net ecosystem carbon balance means we’re capturing more carbon.

The grains here are both rye, but the perennials are carbon neutral to actually capturing carbon, versus annuals that release carbon every year.

Lower Profit (can) = Higher Profit

If you’re not as obsessed with the climate effects of agriculture as I am and just want your business to make more money, here’s an example from services.

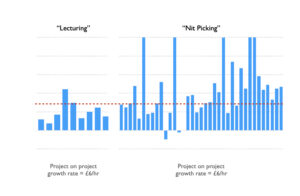

An administrative services firm we know well is targeting growth of its hourly gross profit from £x00 to £x70 (numbers hidden for commercial confidentiality reasons).

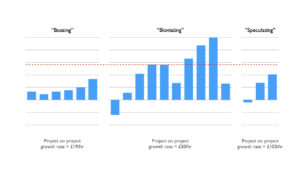

We don’t get very much in this case from looking at the usual categories of client size, service group, and sector. So it’s time to look at a categorisation that reflects an actual underlying driver of profit growth. Anyone who’s offered a service knows that the first time you offer it, it’s a loss maker and gets gradually more profitable over time as you get better at selling and delivering it. So we can recategorise the different services into types of new service and types of established ones. Then we can look at the projects in time order to get something useful. We start with established services (service pseudonyms used to maintain anonymity, the red line is the target hourly rate):

They’re both growing profitability slowly because they’re established. While Nit Picking is a profit machine, it looks like Lecturing isn’t going to make it.

Let’s look at the, less profitable, newer services.

Here it looks like Bossing may or not be worth the investment, Bloviating is going to give us a fair wind of profit growth if we pay attention to it. The low profit Speculating service could be a future star.

This is all really easy and obvious. But if we hadn’t recategorized into new vs established, we wouldn’t have looked at projects in time order and we’d have missed these obvious conclusions.

Better Thinking by Better Categorisation

The key point is to use a categorisation that somehow reflects what you’re trying to assess or analyse, and not just put up with whatever categorisation you inherit.

So rather than looking at each of your services in the same way, maybe categorise them. For example, split services into entry services (where you care about new customer acquisition and creation of follow on business), and follow on services (where you care about uptake per customer and profit). Or recategorise them into high skill services vs low skill, or whatever else drives profit.

Rather than categorise customers into small medium and large or by sector, maybe categorise them into procurement buyers vs operational buyers. Or you could use partnership vs transactional, or high potential vs low potential, or influential vs non influential.

Whatever you choose, if you recategorise into something more meaningful, you’ll get insights that are more meaningful

If you lazily lump things into the same categories everyone else does, or that are in the standard reports, or are the first ones that come to mind then will definitely be missing something while you tuck into your tofu salad on meatless Monday.